Sanity prevails as SEC saves potential equity investors from a world of Hertz

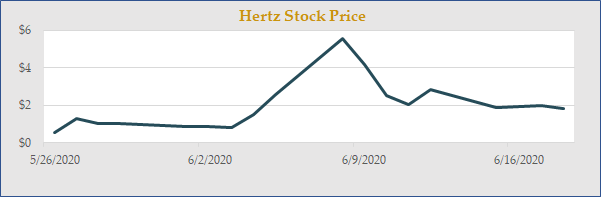

After a share price surge, Hertz Corporation petitioned for and initially received bankruptcy court approval to raise money via a common stock offering. This was a surprising turn of events for a company that recently filed for Chapter 11 protection. The typical bankruptcy process leaves equity holders with securities worth little to no value. Who would invest new money in a bankrupt equity?

Bankruptcy is a process that comes with a cost. A company will often retain a lender to fund a debtor-in-possession (“DIP”) loan that has first priority after the bankruptcy process is complete. In the case of Hertz, it appears they were attempting to raise capital from equity holders to fund part of this process, while likely still having to fund a DIP loan. While the DIP lender would have first priority the equity holder would remain at the end of the line. This is similar to an individual losing their home in foreclosure to a bank then paying the bank the foreclosure costs, and maybe some home improvement costs, so the bank could then sell the property.

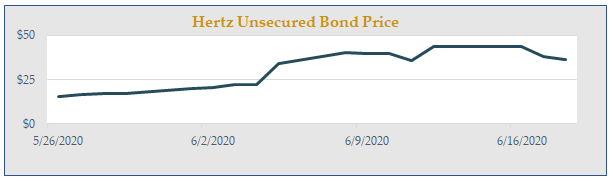

At Penn Capital, we look to the bond market to help frame expectations for a company’s equity. What were Hertz bonds telling us before and after the possible equity deal? Hertz subordinated notes were trading at 30 cents on the dollar and rose to 43 cents on the dollar after the equity raise was announced. After the deal was terminated the bonds fell 10 points from their previous close. So what did we see? An equity issuance would improve the partial recovery of the last tranche of debt holders leaving the equity holders with a total loss.

During bankruptcy proceedings, the value of an enterprise is divvied up amongst stakeholders according to set rules of priority based on the type of claim each stakeholder enjoys. Equity holders are at the back of the line when it comes to receiving payments in a bankruptcy. As we look at the trading levels of Hertz unsecured bonds, the credit market is pricing in a high probability that the value of Hertz as an enterprise is not large enough to repay bondholders what they are owed.

As equity holder claims are lower in priority than bond claims, credit markets are signaling to equity investors the entire value of the company will be divided up amongst secured and unsecured creditors. This leaves little to no available value for equity holders unless the value of Hertz as an enterprise were to significantly expand over the coming weeks and months.

We believe understanding a company’s credit profile is key to developing a view on their potential as an equity investment. While not all instances of credit and equity market disconnects are as glaring as Hertz, we invite you to learn more about how Penn Capital’s credit expertise helps us become better equity investors.

A PDF Version can be found here.